In the ever-evolving and relentless world of crypto, where innovation is the constant heartbeat, a peculiar and potent force has been gaining popularity: Telegram bots.

Over recent months, Telegram bots have carved out a significant niche within the crypto community as they exceeded US$190M in volume in July 2023, according to the Binance Research. Their appeal is straightforward and powerful: users can easily execute crypto activities, from trading and sniping to airdrop farming, all from the palm of their hand.

It’s a convenient and accessible revolution that has been reshaping the crypto landscape. While the ascent of Telegram bots has undeniably enhanced the crypto user experience, it is not without its own set of challenges.

Telegram bots typically employ 2 common revenue streams. Firstly, they often levy a fee on users for executing trades through their bots. Secondly, they impose taxes on transactions involving the bots’ native tokens. The latter approach can be viewed as more contentious, as it places an additional financial burden on users, sometimes upward of 5% per trade.

The reason why most of these protocols implement this tax revenue stream is because of how substantial it is. For instance, consider Unibot, which, as of the time of writing this article, has amassed a lifetime revenue of 8,863 ETH in fees. Interestingly, 80% of this sum (7,066 ETH) can be attributed to Unibot’s tax revenue stream, according to the Dune dashboard by whale_hunter.

Some might argue that the buy and sell taxes can be mitigated by engaging in an Over-the-counter (OTC) trade. In order to participate in an OTC trade, an OTC desk is often mediating these types of transactions. An issue arises when OTC desks do not support the majority of the coins that users would like to trade, especially the ones with lower market capitalizations.

In this situation, another option is to make use of a so-called Escrow service, which comes with its own set of risks, both permissioned and third-party risk. Too often, OTC deals via Escrow service still go wrong these days.

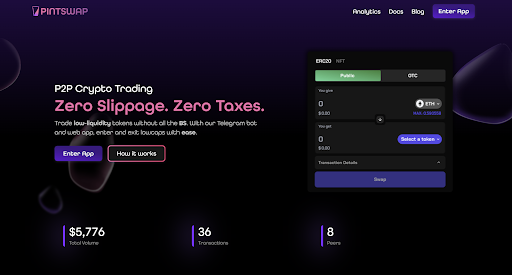

Within the landscape of Telegram bots and their intricate revenue mechanisms, a promising solution takes shape in the form of PintSwap. This innovative protocol sets its sights on addressing the challenges that traditionally come with Telegram bots and OTC desks.

PintSwap is a Decentralized Exchange (DEX) protocol that employs a hybrid OTC/Order book model, with a Telegram bot feature as one of its integral components. It proudly positions itself as a truly permissionless platform, granting users the freedom to engage in OTC trades for any ERC-20 token of their choice.

These transactions can seamlessly harness the power of PintSwap’s Telegram bot, all while the underlying PintSwap protocol operates discreetly in the background, emphasizing its commitment to enhancing the user experience. Moreover, users will find solace in the fact that they need not grapple with buy and sell taxes on their token transactions, only a nominal 1% trading fee.

As the crypto landscape continues to evolve, it is essential to embrace innovative solutions like PintSwap.Telegram bots have come a long way, and with protocols like PintSwap leading the charge, the future of crypto holds the promise of enhanced accessibility, convenience, and user empowerment. It’s worth noting that PintSwap is on the brink of its Token Generation Event (TGE).

The journey is far from over, and as we move forward, let’s keep a watchful eye on the ever-thriving crypto ecosystem for more groundbreaking developments and user-centric solutions.

Twitter – https://twitter.com/pintswap0x

Website – https://pintswap.exchange

Discord – http://discord.gg/pintswap

Litepaper – https://iron.pyrosec.gg/pintswap-litepaper.pdf